Chairman Corey Stewart speaks adamantly in favor of tripling the computer-related business tax at the April 17, 2018 budget markup meeting.

Chairman Corey Stewart speaks adamantly in favor of tripling the computer-related business tax at the April 17, 2018 budget markup meeting.At their April 17 budget markup, Prince William County Supervisors decided to table a decision on a proposal to triple a tax that primarily affects data centers, the programmable computer equipment and peripheral business tax.*

The tax could have provided a windfall for county revenue, but supervisors worried it could make the county less attractive to businesses.

Chairman At-large Corey Stewart (R) proposed an ambitious tax plan for FY19 and future years. He hoped to raise an additional $21.7 million in continuous annual revenue to put towards priority projects that would be difficult to fund within the existing budget.

The plan rests on ended a tax incentives that dates back to 1999.

First, and foremost with the additional revenue, Stewart hoped to stave off a large fire levy increase intended to improve retention. Phase I, in FY19, would cost $610,000; Phase II, in FY20, $6.9 million.

Stewart suggested $6.7 million could fund both phases of the plan continuously. Best of all, they would have will plenty of money left over to spend elsewhere.

With the remainder of funds, he suggested providing a $9 million net increase to the schools, possibly to be used for infrastructure needs; providing residents with a property tax cut (1 cent per the tax rate), and funding various pet projects such as park improvements.

Stewart framed it as an issue of prioritizing public safety - literally saving people’s lives - by supporting first responders, and shifting the tax burden away from the residents.He also said it was an issue of fairness because data centers received a 20-year-tax incentive that other business and residents have not.

“We’re talking about the citizens versus Amazon, and Microsoft, and Google and Facebook and Apple. And let me tell you something about those companies: they have more pull on every level of government including down in Richmond,” said Stewart, predicting they will soon get a “sweetheart” deal from the Commonwealth.

Gainesville Supervisor Pete Candland (R), who is opposed to Amazon moving into a nonindustrial area of his district, supported the proposal. Candland had previously proposed a levy to help reduce school overcrowding. He was hopeful that the $9 million could solve some of those problems without need for an additional tax increase.

“I guess my big concern is if we don’t have a plan like this that aggressively addresses I’m afraid we’re not going to get this done,” Candland said.

He also liked that Stewart's plan did not raise taxes on residents.

However, while everyone liked the spoils Stewart of the tax increase, most had serious reservations about its effect on the business community.

Coles Supervisor Marty Nohe (R), a local business owner, and Brentsville Supervisor Jeanine Lawson (R), who has been encouraging large data center to build within her district, were both adamantly opposed.

Lawson said a representative of Iron Mountain data center told her they would abandon their plans to expand within the county. Lawson said data centers pay other county taxes that are beneficial to the tax base. She argued raising business taxes would work against the board's stated goal of expanding their business tax-base.

“I think we should stay the course…keep Prince William County the business-friendly community it is known to be,” Lawson said.

Nohe said the move could also make them look capricious to all businesses.

But Stewart argued that data centers were not getting any kind of sweetheart deal in Loudoun County, and yet that neighbor has five times the data centers Prince William does. However, Loudoun County, especially the Ashburn area, is a national hub for the data center industry.

Ultimately, most supervisors did not support the proposal.

Based on the recommendation of Woodbridge Supervisor Frank Principi (D), they directed the County Executive Chris Martino “to investigate tax policy” and “to engage data centers.”

Based on the recommendation of Woodbridge Supervisor Frank Principi (D), they directed the County Executive Chris Martino “to investigate tax policy” and “to engage data centers.”

The board asked that staff bring back the findings next year along with taking a holistic look at business taxes and business growth in the county.

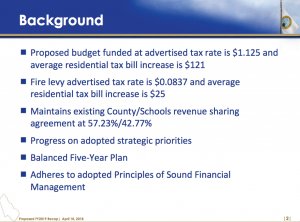

The county’s total proposed expenditure for FY19 is $3.059 billion, including $1.5 billion to the school division and $1.55 to other county services.

The advertised tax rate remains flat from last year at $1.125 per $100 of assessed value. The average residential tax increase for FY19 will be $125.

Once the tax rate has been advertised, it cannot be increased, only decreased. Budget adoption is scheduled for April 24 at 7:30 p.m. at the McCourt Building.

*Correction: the word "programmable" was left out of the tax designation at the time of publication.

Support Bristow Beat - Donate Today!